Navigating the complex world of financing partnerships requires a keen understanding of legal frameworks, financial intricacies, and strategic alliances. This guide delves into the multifaceted nature of these agreements, exploring various structures, from equity partnerships to joint ventures, and offering insights into due diligence, negotiation, and risk management. We examine the critical success factors, highlighting both triumphant collaborations and cautionary tales of failed ventures, ultimately providing a roadmap for building and sustaining profitable partnerships.

The landscape of business collaborations is ever-evolving, with financing partnerships playing an increasingly crucial role in driving growth and innovation. This analysis explores the diverse models available, the essential elements of successful negotiation, and the long-term strategies for maximizing returns while mitigating potential risks. From the initial stages of due diligence to the eventual exit strategy, we offer a practical framework for navigating this complex terrain.

Defining Financing Partnerships

Financing partnerships represent a broad spectrum of collaborative arrangements where two or more entities pool resources, expertise, or risk to achieve a shared financial objective. These partnerships can range from simple joint ventures to complex, multi-layered structures involving banks, private equity firms, government agencies, and corporations. The defining characteristic is the synergistic combination of capital and/or other assets to undertake projects or ventures that would be difficult or impossible for any single participant to accomplish alone.Financing partnerships differ significantly from other business collaborations, such as mergers or acquisitions, through their emphasis on shared financial risk and reward, rather than a complete integration of operations or ownership.

Unlike mergers, which result in a single entity, financing partnerships maintain the separate legal identities of the participating entities. Joint ventures, while sharing similarities, often focus on operational collaboration, whereas financing partnerships may prioritize financial structuring and risk allocation above all else. Strategic alliances may involve financial aspects, but financing partnerships are fundamentally defined by their core focus on shared financial objectives and risk-sharing mechanisms.

Types of Financing Partnerships and Legal Structures

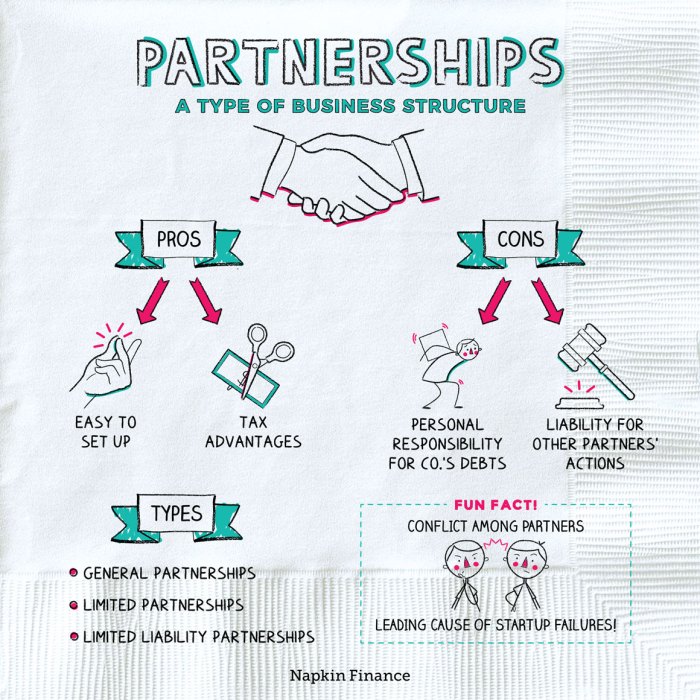

Financing partnerships can take various forms, each with distinct legal and regulatory implications. Common structures include joint ventures, syndicated loans, private equity partnerships, and public-private partnerships (PPPs). Joint ventures typically involve the creation of a new legal entity, with shared ownership and governance structures. Syndicated loans, conversely, involve multiple lenders providing funding to a single borrower, sharing the risk and reward proportionally.

Private equity partnerships pool capital from investors to invest in companies, typically with a structured exit strategy. PPPs involve collaboration between public and private sectors to finance and implement infrastructure projects, often governed by specific contractual agreements and regulatory frameworks. The legal and regulatory aspects are highly dependent on the specific structure, jurisdiction, and the nature of the underlying project or investment.

For instance, joint ventures will be governed by partnership agreements, while syndicated loans are subject to loan agreements and banking regulations. PPPs often require compliance with procurement regulations and public accountability standards. The choice of structure significantly impacts liability, taxation, and regulatory compliance.

Types of Financing Partnerships

Financing partnerships come in various forms, each tailored to specific needs and risk tolerances. The choice depends heavily on the strategic objectives of the involved parties, the nature of the project, and the desired level of control. Understanding the nuances of each type is crucial for successful collaboration and optimal financial outcomes.

Equity Partnerships

Equity partnerships involve two or more parties contributing capital in exchange for an ownership stake in the venture. This structure often leads to shared decision-making and profit/loss sharing proportional to ownership. The key characteristic is the pooling of resources and expertise to achieve a common goal. Equity partnerships are suitable for projects requiring significant capital investment and where shared risk and reward are desirable.

Debt Financing Partnerships

In contrast to equity partnerships, debt financing partnerships involve one party providing capital as a loan to another. The lender receives interest payments and repayment of the principal, while the borrower retains full ownership and control of the venture. This structure is preferred when one party has a clear need for capital but wants to retain full operational control.

The risk is generally lower for the lender compared to an equity investment, as they are entitled to repayment regardless of the venture’s profitability.

Joint Ventures

Joint ventures are a specific type of partnership where two or more entities create a separate legal entity to undertake a specific project or business venture. This structure offers a degree of protection for the parent companies’ assets, while allowing for collaboration and resource sharing. Joint ventures are particularly beneficial for projects requiring specialized expertise or access to specific markets, and provide a structured framework for managing shared responsibilities and risks.

| Type | Advantages | Disadvantages | Example |

|---|---|---|---|

| Equity Partnership | Shared risk and reward, pooled resources and expertise, potential for significant returns | Potential for disagreements among partners, slower decision-making process, dilution of ownership | Two tech startups merging to create a larger, more competitive company. |

| Debt Financing Partnership | Retains full ownership and control, predictable repayment terms, lower risk for the lender (compared to equity) | Increased financial burden for the borrower, interest payments reduce profitability, potential for default | A small business securing a loan from a bank to expand its operations. |

| Joint Venture | Shared resources and expertise, access to new markets, limited liability for parent companies | Complex legal structure, potential for conflicts between partners, slower decision-making due to multiple stakeholders | Two automotive manufacturers collaborating to develop and produce a new electric vehicle model. |

Due Diligence in Financing Partnerships

Thorough due diligence is paramount before entering any financing partnership. A comprehensive assessment safeguards against potential risks and ensures the long-term success of the collaboration. Overlooking this crucial step can lead to significant financial losses and reputational damage. This section details the essential components of a robust due diligence process.

Financial Health and Stability Assessment

Assessing the financial health and stability of potential partners is critical. This involves a rigorous review of their financial statements, including balance sheets, income statements, and cash flow statements, spanning at least three to five years. Analyzing key financial ratios such as profitability margins, debt-to-equity ratios, and liquidity ratios provides insights into their financial performance and risk profile.

Furthermore, examining their credit history and ratings from agencies like Moody’s or S&P offers an independent perspective on their creditworthiness. Inconsistencies or red flags in financial reporting warrant further investigation and potentially disqualify the partner. For example, a consistently declining revenue stream or a high level of debt relative to equity could indicate financial instability and pose significant risks to the partnership.

Legal and Regulatory Compliance Evaluation

Evaluating the legal and regulatory compliance of a potential partner is equally vital. This involves reviewing their legal documentation, including articles of incorporation, operating agreements, and any relevant licenses or permits. A thorough review ensures the partner operates within the bounds of the law and complies with all applicable regulations. This also includes investigating any past legal disputes or litigation, which can reveal potential liabilities and compliance issues.

For instance, a history of regulatory violations or ongoing legal battles could significantly impact the partnership’s stability and reputation. Furthermore, conducting background checks on key personnel can help uncover any potential conflicts of interest or ethical concerns. A failure to conduct thorough legal due diligence can expose the partnership to significant legal and financial risks.

Due Diligence Checklist

A comprehensive due diligence checklist should encompass various aspects. This involves a structured approach to gather and analyze relevant information, ensuring no critical area is overlooked.

- Financial Statements Review: Analyze balance sheets, income statements, and cash flow statements for at least three to five years. Calculate key financial ratios and assess trends.

- Credit History and Ratings: Obtain credit reports and ratings from reputable agencies to evaluate creditworthiness.

- Legal Documentation Review: Review articles of incorporation, operating agreements, licenses, and permits to ensure legal compliance.

- Legal Disputes and Litigation History: Investigate any past or ongoing legal disputes or litigation.

- Background Checks on Key Personnel: Conduct background checks on key individuals to identify potential conflicts of interest or ethical concerns.

- Management Team Assessment: Evaluate the experience, expertise, and reputation of the management team.

- Operational Due Diligence: Assess the partner’s operational efficiency, infrastructure, and technology.

- Market Analysis: Evaluate the partner’s market position, competitive landscape, and growth potential.

- Environmental, Social, and Governance (ESG) Factors: Consider the partner’s ESG performance and alignment with the partnership’s values.

- Intellectual Property Review: Assess the partner’s intellectual property portfolio and its protection.

Negotiating Partnership Agreements

Securing a robust financing partnership hinges on a meticulously crafted agreement. This document serves as the bedrock of the relationship, outlining the terms and conditions under which the partners will operate, and providing a framework for navigating potential disagreements. A well-defined agreement minimizes future conflicts and ensures a smooth, productive collaboration.Negotiating a financing partnership agreement requires careful consideration of various legal and financial aspects.

The process involves balancing the interests of each partner while establishing clear expectations regarding roles, responsibilities, and financial arrangements. Failure to address these critical elements can lead to disputes and ultimately jeopardize the success of the partnership.

Key Clauses in a Financing Partnership Agreement

A comprehensive financing partnership agreement should include several essential clauses. These clauses provide a clear and unambiguous understanding of the partnership’s structure, operations, and financial arrangements. Omitting key clauses can lead to ambiguity and disputes down the line.

- Partnership Purpose and Scope: A precise description of the partnership’s objectives, including the types of investments, target markets, and investment strategies. For example, “The partnership’s purpose is to invest in early-stage technology companies in the renewable energy sector within North America.”

- Capital Contributions: A detailed breakdown of each partner’s financial contribution, including the amount, form (cash, in-kind), and payment schedule. This section might include provisions for future capital calls.

- Profit and Loss Sharing: A clear definition of how profits and losses will be allocated among the partners. This could be based on a fixed percentage, a ratio reflecting capital contributions, or a more complex formula based on performance metrics. For example, a 60/40 split of profits, with a corresponding allocation of losses.

- Management and Decision-Making: A clear delineation of each partner’s responsibilities and decision-making authority. This may involve establishing a management committee or outlining specific areas of responsibility for each partner.

- Dispute Resolution: A mechanism for resolving disagreements, such as mediation, arbitration, or litigation. This clause is crucial for mitigating potential conflicts and ensuring a fair and efficient resolution process.

- Exit Strategy: A plan for dissolving the partnership, including procedures for withdrawing partners, transferring ownership, or liquidating assets. This should include provisions for buy-sell agreements or other mechanisms for partner buyouts.

- Confidentiality: A clause protecting confidential information shared between partners, including financial data, investment strategies, and business plans.

Defining Roles, Responsibilities, and Profit/Loss Sharing

Clearly defining roles, responsibilities, and profit/loss sharing mechanisms is paramount to a successful financing partnership. Ambiguity in these areas can create friction and hinder the partnership’s progress. The agreement should assign specific tasks and responsibilities to each partner, ensuring accountability and efficient operation.Profit and loss sharing should be equitable and aligned with each partner’s contribution and risk. For instance, a partner providing significant capital might receive a larger share of profits but also bear a larger portion of losses.

A well-defined formula ensures transparency and prevents future disagreements regarding financial distribution. For example, a partnership agreement could stipulate a tiered profit-sharing structure, rewarding partners based on both capital contribution and performance metrics.

Strategies for Resolving Conflicts

Proactive conflict resolution mechanisms are essential for maintaining a healthy financing partnership. The agreement should incorporate clauses that encourage open communication and provide a structured approach to resolving disagreements.

- Mediation: A neutral third party facilitates communication and helps partners reach a mutually agreeable solution. Mediation is often a less adversarial and more cost-effective approach than litigation.

- Arbitration: A neutral arbitrator hears evidence and makes a binding decision. Arbitration is a more formal process than mediation but can be quicker and less expensive than litigation.

- Litigation: As a last resort, partners may choose to resolve disputes through the court system. Litigation is typically the most expensive and time-consuming option.

The agreement should specify which method of dispute resolution will be used and Artikel the procedures to be followed. For example, the agreement might state that all disputes will first be attempted through mediation, with arbitration as a secondary option if mediation fails. This proactive approach minimizes the likelihood of costly and time-consuming legal battles.

Managing a Financing Partnership

Effective management is crucial for the success of any financing partnership. A well-structured approach to communication, financial oversight, and adaptability ensures the partnership thrives, even amidst market volatility. Ignoring these aspects can lead to conflict, poor performance, and ultimately, dissolution.

Communication and Collaboration Systems

Open and frequent communication forms the bedrock of a successful financing partnership. A clearly defined communication protocol, utilizing both formal and informal channels, is essential. Formal channels might include regularly scheduled partner meetings (e.g., monthly or quarterly), documented through minutes and action items. Informal channels, such as instant messaging or email chains for quick updates, can facilitate quicker responses to pressing issues.

A centralized platform, such as a shared project management software, can consolidate all communication and relevant documentation, ensuring transparency and easy access for all partners. This system should also clearly define roles and responsibilities for each partner, minimizing confusion and overlap. For example, one partner might be responsible for investor relations, while another manages operational aspects.

Financial Reporting and Performance Monitoring

Regular and comprehensive financial reporting is vital for monitoring the partnership’s performance and identifying potential problems early on. A standardized reporting format, agreed upon by all partners, should be implemented. This might include monthly or quarterly reports detailing key performance indicators (KPIs) such as net asset value (NAV), internal rate of return (IRR), and cash flow. These reports should be presented in a clear and concise manner, avoiding technical jargon that might be inaccessible to all partners.

Regular review meetings should be scheduled to discuss these reports, allowing partners to analyze performance, address deviations from projections, and make necessary adjustments to the investment strategy. Independent audits, particularly for larger partnerships, can provide an additional layer of assurance and transparency. For instance, a quarterly audit by a reputable accounting firm could offer an objective assessment of the partnership’s financial health.

Adapting to Changing Market Conditions

The financial landscape is constantly evolving. Therefore, a robust strategy for adapting to changing market conditions is paramount for long-term viability. This necessitates a flexible investment strategy that can be adjusted based on market shifts. For example, a partnership heavily invested in a specific sector might need to diversify its portfolio if that sector experiences a downturn.

Regular market analysis and scenario planning are essential tools for anticipating potential risks and opportunities. This could involve monitoring economic indicators, geopolitical events, and regulatory changes that might impact the partnership’s investments. Furthermore, a well-defined risk management framework, encompassing procedures for identifying, assessing, and mitigating potential risks, is crucial. This might include diversification across asset classes, hedging strategies, and contingency plans for unforeseen events, such as a sudden economic recession.

The partnership agreement should explicitly address how to handle significant market shifts, outlining procedures for decision-making and conflict resolution. For example, it should specify the process for adjusting the investment strategy or reallocating capital if market conditions warrant it.

Risk Management in Financing Partnerships

Financing partnerships, while offering significant opportunities for growth and profitability, inherently carry a range of risks that must be proactively identified and mitigated. Effective risk management is crucial for ensuring the long-term success and stability of these ventures. A comprehensive approach involves assessing potential financial, legal, and operational challenges, developing tailored mitigation strategies, and regularly monitoring the risk landscape.

Financial Risks in Financing Partnerships

Financial risks represent a core concern in any financing partnership. These risks stem from the inherent uncertainties associated with investment returns, market fluctuations, and the financial stability of partners. Potential issues include defaults on loan repayments, unexpected changes in interest rates, and the devaluation of assets held within the partnership. A robust risk management plan addresses these concerns through thorough due diligence on partner financials, diversification of investments, and the incorporation of appropriate financial covenants within the partnership agreement.

For instance, a detailed financial projection model, stress-tested against various economic scenarios, can provide valuable insights into potential financial vulnerabilities. Further, incorporating contingency plans for unforeseen events, such as a sudden downturn in the market, can significantly reduce the impact of negative financial outcomes.

Legal Risks in Financing Partnerships

Legal risks arise from the complexities of partnership agreements, regulatory compliance, and potential disputes among partners. These can range from disagreements over governance structures to issues related to intellectual property rights or breaches of contract. Mitigation strategies include meticulous drafting of partnership agreements that clearly Artikel the rights, responsibilities, and liabilities of each partner. Regular legal review of the agreement and compliance with relevant regulations are also essential.

For example, seeking legal counsel specializing in partnership law can ensure that the agreement is comprehensive and enforceable, mitigating the risk of costly litigation. Furthermore, establishing clear dispute resolution mechanisms within the agreement, such as arbitration clauses, can streamline the process of resolving conflicts efficiently.

Operational Risks in Financing Partnerships

Operational risks encompass a broad range of challenges related to the day-to-day management and execution of the partnership’s activities. These can include difficulties in coordinating activities between partners, unforeseen operational challenges, and failures in internal controls. Effective mitigation involves establishing clear communication channels, developing robust operational procedures, and implementing regular performance monitoring. For example, a well-defined project management plan, outlining key milestones and responsibilities, can enhance coordination and minimize delays.

Regular audits of operational processes can identify weaknesses and ensure adherence to established procedures, thereby reducing the risk of operational failures.

Risk Assessment Matrix

A risk assessment matrix provides a structured approach to identifying, analyzing, and prioritizing risks. The matrix below illustrates a sample assessment, highlighting the likelihood and impact of various risks, along with corresponding mitigation strategies. Note that the likelihood and impact are subjective assessments and should be tailored to the specific context of the partnership.

| Risk | Likelihood | Impact | Mitigation Strategy |

|---|---|---|---|

| Partner Default | Medium | High | Thorough due diligence, strong covenants in partnership agreement, collateralization |

| Regulatory Changes | Low | Medium | Regular monitoring of regulatory landscape, legal counsel |

| Market Volatility | High | High | Diversification of investments, hedging strategies |

| Operational Inefficiencies | Medium | Medium | Robust operational procedures, regular performance monitoring |

| Partner Disputes | Low | High | Clearly defined roles and responsibilities, robust dispute resolution mechanisms |

Exiting a Financing Partnership

Exiting a financing partnership requires careful planning and execution, as the process can significantly impact the financial standing and future prospects of all involved parties. The optimal exit strategy depends on various factors, including the partnership agreement, the current market conditions, and the individual goals of each partner. A poorly managed exit can lead to disputes, legal battles, and substantial financial losses.

Buyout of a Partner

A buyout involves one or more partners purchasing the stake of another partner. This method is often preferred when the departing partner wishes to liquidate their investment while the remaining partners want to continue the business. The valuation of the departing partner’s stake is crucial and usually determined through an independent appraisal, following the stipulations Artikeld in the partnership agreement.

This process necessitates a detailed examination of the partnership’s assets, liabilities, and projected future earnings. Disagreements over valuation are common and can lead to protracted negotiations or even litigation. Funding for the buyout can come from the remaining partners’ personal funds, external financing, or a combination of both. Legal counsel is essential to ensure the buyout agreement protects the interests of all parties and complies with relevant laws and regulations.

Partnership Dissolution

Dissolution refers to the formal termination of the financing partnership. This often involves the liquidation of partnership assets to repay creditors and distribute remaining funds to the partners according to the terms of the partnership agreement. Dissolution can be triggered by various events, including the expiration of the partnership’s term, the death or incapacity of a partner, or a breach of the partnership agreement.

The process can be complex and time-consuming, requiring the meticulous accounting of all assets and liabilities, the satisfaction of all creditor claims, and the equitable distribution of any remaining funds. Legal and accounting expertise are vital to navigate the dissolution process efficiently and minimize potential disputes. Failure to properly follow legal procedures can result in significant financial and legal repercussions for all involved.

Sale of the Partnership

Selling the entire financing partnership to a third party is another exit strategy. This approach offers a complete exit for all partners, providing a potentially lucrative return on their investment. The valuation of the partnership will depend on factors such as its financial performance, market conditions, and the attractiveness of its assets and future prospects. Finding a suitable buyer can take considerable time and effort, requiring marketing the partnership to potential acquirers and negotiating favorable terms.

Due diligence by the buyer is standard practice, and the partners must be prepared to provide comprehensive information about the partnership’s operations and financial performance. Legal representation is critical to ensure a smooth and legally sound transaction. A well-structured sale agreement will protect the interests of the partners and clearly define the terms of the sale, including the purchase price, payment schedule, and any post-sale obligations.

Step-by-Step Guide for Navigating the Exit Process

A smooth and efficient exit process requires a structured approach. First, review the partnership agreement to understand the provisions related to exiting the partnership. Next, determine the preferred exit strategy based on the partners’ goals and the partnership’s circumstances. Then, engage legal and financial professionals to advise on the legal and financial implications of the chosen strategy.

Following this, conduct thorough due diligence to assess the value of the partnership and identify potential risks. Subsequently, negotiate the terms of the exit with the relevant parties, ensuring a fair and equitable outcome for all involved. Finally, execute the chosen exit strategy, ensuring compliance with all legal and regulatory requirements. Throughout the process, maintain open communication among partners and with external advisors to address any challenges or disagreements promptly and effectively.

Case Studies of Successful Financing Partnerships

Successful financing partnerships are characterized by a clear alignment of strategic goals, robust due diligence processes, and effective communication between partners. Analyzing these partnerships reveals key strategies and factors that contribute to their success, providing valuable lessons for future collaborations. Conversely, examining failed partnerships highlights pitfalls to avoid.

The Blackstone-Starwood Partnership: Real Estate Investment

Blackstone and Starwood Capital Group’s collaboration in real estate investment exemplifies a highly successful financing partnership. Their combined expertise – Blackstone’s vast capital resources and Starwood’s deep real estate market knowledge – allowed them to capitalize on significant investment opportunities. Their success stemmed from a clearly defined investment strategy, rigorous due diligence procedures, and a well-structured partnership agreement that Artikeld responsibilities, profit-sharing, and dispute resolution mechanisms.

This partnership has generated substantial returns for both firms through numerous successful real estate projects, demonstrating the power of combining financial strength with specialized market knowledge.

Sequoia Capital and Airbnb: Venture Capital Financing

The financing partnership between Sequoia Capital, a prominent venture capital firm, and Airbnb, the disruptive hospitality platform, showcases the benefits of early-stage investment in high-growth companies. Sequoia’s early investment provided crucial capital for Airbnb’s expansion, while Airbnb’s innovative business model and strong management team delivered exceptional returns. The success of this partnership highlights the importance of identifying companies with strong growth potential and providing them with the necessary resources and guidance to scale.

Furthermore, the partnership benefited from a strong alignment of interests and a flexible agreement that allowed for adjustments as the company evolved.

The Failure of the Yahoo!-Microsoft Search Partnership

In contrast to the successes described above, the partnership between Yahoo! and Microsoft in the search engine market demonstrates the potential pitfalls of such collaborations. While initially intended to enhance competition against Google, the partnership ultimately failed to achieve its objectives. Lack of clear strategic alignment, differing corporate cultures, and difficulties in integrating the respective technologies contributed to the partnership’s demise.

This case study underscores the importance of thorough due diligence, clear communication, and a shared vision for success in any financing partnership. The inability to effectively manage differing corporate cultures and integrate complex technologies proved to be fatal flaws.

Illustrative Examples of Financing Partnership Structures

Financing partnerships can take various forms, each with unique implications for the partners involved. The optimal structure depends heavily on the specific goals, risk tolerance, and capital contributions of each party. Three common structures are detailed below, highlighting their key characteristics and potential advantages and disadvantages.

Joint Venture

A joint venture (JV) is a common financing partnership structure where two or more entities pool resources and expertise to undertake a specific project or venture. Each partner retains its separate legal identity, but a new entity is often created to manage the JV’s operations. This structure offers a degree of risk mitigation, as losses are shared among the partners.

However, it also requires careful coordination and agreement on decision-making processes.

- Capital Contribution: Partners contribute capital according to a pre-agreed ratio, which may reflect their relative expertise or market share. For example, a technology company might contribute intellectual property and development expertise, while a financial institution contributes capital and market access.

- Profit and Loss Sharing: Profits and losses are typically shared proportionally to each partner’s capital contribution or a negotiated agreement. This can be adjusted to reflect the differing roles and responsibilities of the partners.

- Management Structure: A joint management committee is often established, with representatives from each partner. Decision-making processes are usually Artikeld in the JV agreement, specifying voting rights and dispute resolution mechanisms.

- Example: A large pharmaceutical company forming a JV with a smaller biotech firm to develop and market a new drug. The pharmaceutical company provides funding and distribution channels, while the biotech firm contributes its specialized scientific knowledge.

Limited Partnership

A limited partnership (LP) involves a general partner who manages the business and assumes unlimited liability, and one or more limited partners who contribute capital but have limited liability and limited involvement in management. This structure offers a balance between risk and control. Limited partners are typically passive investors, while the general partner bears the primary responsibility for the partnership’s success or failure.

- Capital Contribution: Limited partners typically contribute a significant portion of the capital, while the general partner may contribute less capital but more managerial expertise and time.

- Profit and Loss Sharing: Profits and losses are usually shared according to a pre-agreed ratio, reflecting the capital contributions and management responsibilities. The general partner often receives a larger share of the profits in recognition of their greater risk and involvement.

- Management Structure: The general partner has full management control, while limited partners have limited or no involvement in day-to-day operations. This structure allows for specialized expertise to be leveraged efficiently.

- Example: A real estate development project where a seasoned developer (general partner) partners with high-net-worth individuals (limited partners) to fund the acquisition and development of a property. The limited partners provide capital, while the general partner manages the project.

Consortium

A consortium involves a group of companies or institutions collaborating on a large-scale project, typically requiring significant capital and expertise. Each participant retains its independent legal identity and contributes specific resources. Consortiums are often used for complex infrastructure projects or large-scale research initiatives. They offer the benefit of pooling diverse resources and sharing risks, but can be complex to manage due to the involvement of multiple parties.

- Capital Contribution: Each member contributes capital and resources according to its capabilities and the project’s needs. This might include financial resources, technology, expertise, or access to markets.

- Profit and Loss Sharing: Profit and loss sharing is determined by a pre-agreed formula, often reflecting the relative contribution of each member. This can be complex to negotiate and requires careful consideration of each partner’s contribution.

- Management Structure: A steering committee or management board is typically established to oversee the consortium’s activities. Effective communication and coordination are crucial for the success of the consortium.

- Example: A group of banks forming a consortium to finance a large infrastructure project, such as a new airport or high-speed rail line. Each bank contributes a portion of the funding and shares the associated risks and rewards.

Impact of Financing Partnerships on Business Growth

Financing partnerships offer a powerful catalyst for business growth, providing access to capital and resources that might otherwise be unavailable. Strategic alliances with financial institutions or investors can unlock significant opportunities for expansion, innovation, and increased market share. However, it’s crucial to carefully weigh the potential benefits against the associated risks and implications for the company’s financial health.The infusion of capital from a financing partnership can directly accelerate a company’s growth trajectory.

This influx of funds allows for increased investment in research and development, leading to the creation of new products or services and improved existing offerings. Furthermore, it enables expansion into new markets, the acquisition of complementary businesses, or the scaling of existing operations to meet increased demand. Access to a partner’s expertise and network can also be invaluable, providing strategic guidance and opening doors to new opportunities.

Accelerated Business Expansion Through Financing Partnerships

Financing partnerships provide the necessary capital to fuel expansion strategies. This can involve opening new physical locations, expanding into new geographical markets, or increasing production capacity to meet growing demand. For example, a small technology startup securing venture capital funding can use the investment to scale its operations, hire additional staff, and develop its software platform. The partnership might also provide access to mentorship and industry contacts, further accelerating growth.

This contrasts sharply with organic growth, which relies solely on internally generated funds and may be limited by slower revenue generation.

Benefits and Drawbacks of External Financing Partnerships

Several advantages accompany securing external financing through partnerships. These include access to capital, expertise, and networks, all of which can propel business growth. Conversely, drawbacks include potential dilution of ownership, loss of control over certain business decisions, and the need to meet the partner’s expectations and performance targets. For instance, a company accepting equity financing may need to cede some control to its investors, potentially influencing strategic direction.

Similarly, loan agreements may come with stringent conditions that impact the company’s flexibility and financial planning.

Impact on Financial Statements and Overall Performance

A financing partnership significantly impacts a company’s financial statements. An equity investment, for example, will increase the company’s equity capital but also dilute existing shareholders’ ownership. Debt financing, on the other hand, increases liabilities, affecting debt-to-equity ratios and potentially impacting credit ratings. The impact on overall performance is multifaceted. Increased revenue and market share are likely outcomes, but profitability may be temporarily affected by increased interest payments or dividend obligations.

A comprehensive financial model should be developed to assess the long-term financial implications of the partnership. For instance, a successful partnership could lead to higher earnings per share (EPS) and improved return on assets (ROA) in the long run, while a poorly managed partnership could lead to increased financial risk and reduced profitability.

Ethical Considerations in Financing Partnerships

Financing partnerships, while offering significant opportunities for growth and profitability, necessitate a robust ethical framework to ensure fairness, transparency, and long-term sustainability. Ignoring ethical considerations can lead to reputational damage, legal repercussions, and the erosion of trust among partners. A commitment to ethical conduct is paramount from the initial stages of partnership formation through to its eventual dissolution.

Conflicts of Interest

Conflicts of interest represent a significant ethical challenge in financing partnerships. These arise when a partner’s personal interests, or the interests of a related entity, conflict with the interests of the partnership as a whole. For example, a partner might have a personal investment in a competing business, potentially leading to biased decision-making regarding resource allocation or strategic partnerships.

Addressing such conflicts requires proactive measures, including clear disclosure policies, independent valuation processes, and robust conflict-of-interest management protocols. Partners should be obligated to disclose any potential conflicts and recuse themselves from decisions where a conflict might influence their judgment. Transparency in financial dealings and a commitment to acting in the best interests of the partnership are critical in mitigating these risks.

Transparency and Accountability

Maintaining transparency and accountability is crucial for building and sustaining trust within a financing partnership. All financial transactions, including capital contributions, distributions, and expenses, should be meticulously documented and readily accessible to all partners. Regular reporting, including financial statements and performance reviews, should be provided to ensure partners have a clear understanding of the partnership’s financial health and operational performance.

Independent audits can enhance accountability and provide an objective assessment of the partnership’s financial activities. Establishing clear roles and responsibilities, along with mechanisms for dispute resolution, further reinforces transparency and accountability. For example, a well-defined governance structure with clearly articulated decision-making processes will minimize ambiguity and potential for disputes.

Fairness and Equity

Equity and fairness are cornerstones of ethical financing partnerships. All partners should have equitable access to information, opportunities, and resources. Profit and loss sharing should be clearly defined in the partnership agreement, reflecting the contributions and responsibilities of each partner. Decisions regarding investment strategies, operational matters, and distributions should be made in a fair and impartial manner, avoiding favoritism or preferential treatment of any single partner.

Regular reviews of the partnership agreement and its implementation are essential to ensure ongoing fairness and equity. Disputes should be resolved through established mechanisms, such as mediation or arbitration, that prioritize fairness and due process.

Confidentiality and Data Protection

Financing partnerships often involve sensitive financial and business information. Maintaining confidentiality is paramount, both internally within the partnership and externally to third parties. Partners should be bound by confidentiality agreements, protecting sensitive data from unauthorized access or disclosure. Compliance with data protection regulations, such as GDPR or CCPA, is essential to protect the privacy of individuals and businesses involved in the partnership.

Implementing robust security measures to safeguard sensitive information, including encryption and access controls, is crucial. Regular security audits and employee training can help mitigate the risk of data breaches and maintain confidentiality.

Environmental, Social, and Governance (ESG) Considerations

Increasingly, investors and stakeholders are demanding greater transparency and accountability in ESG matters. Ethical financing partnerships should incorporate ESG considerations into their investment decisions and operational practices. This might involve prioritizing investments in sustainable businesses, promoting diversity and inclusion within the partnership and its portfolio companies, and adhering to high ethical standards in all aspects of operations. Integrating ESG factors into investment due diligence and reporting processes ensures that the partnership’s activities align with broader societal and environmental goals.

For example, a partnership might prioritize investments in renewable energy companies or businesses with strong labor practices, demonstrating a commitment to responsible investing.

Epilogue

Successfully structuring and managing a financing partnership demands meticulous planning, robust due diligence, and a clear understanding of the legal and financial implications. This guide has provided a framework for navigating the key aspects, from defining the partnership structure and conducting thorough due diligence to negotiating favorable terms and managing inherent risks. By leveraging the insights presented, businesses can significantly enhance their chances of forging mutually beneficial and enduring partnerships that fuel sustainable growth and unlock new opportunities.